European Consumers Cutting Back on Sugar Consumption

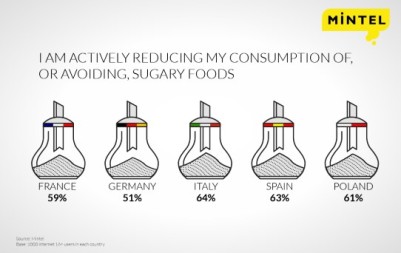

New research unveiled by Mintel reveals that the majority of consumers in key European markets are cutting back on their consumption of sugar. Mintel research finds that more than three in five Italian (64%), Spanish (63%) and Polish (61%) consumers say they are actively reducing or avoiding sugary foods. Additionally, over half of French (59%) and German (51%) consumers say the same. Furthermore, 65% of UK consumers agree that a healthy diet should be low in sugar.

However, while there is strong consumer interest across a number of markets in low sugar products, Mintel research indicates there is a gap in the market for new product launches carrying a low, no or reduced sugar claim. Indeed, the proportion of product launches carrying this claim has hovered at around 5% of all food and drink products launched in Europe over the past five years, according to Mintel’s GNPD (Global New Products Database) service.

Chris Brockman, Food and Drink Research Manager EMEA at Mintel, comments: “Excessive sugar consumption continues to be criticized by the media and health professionals alike, resulting in today’s sugar backlash. This has led to sugar replacing fat and salt as the new dietary pariah across Europe. There is therefore a key opportunity for brands to address consumer fears and adapt their products to carry a low, no or reduced sugar claim.”

Within Europe, Italian consumers show the greatest interest in avoiding sugary foods, just 3% of food and drink products launched so far in 2015 in this country have featured a low, no or reduced sugar claim, up from 2% in 2012. Furthermore, this year just 5% of products launched in Spain, as well as 4% in Poland, France and Germany have carried the low, no or reduced sugar claim. Although these markets have seen limited activity in product innovation around this claim, it seems there has been a surge of activity in the UK market. So far in 2015, some 7% of food and drink products launched in the UK held a low, no or reduced sugar claim, up from 4% in 2012.

Despite the lack of reduced sugar claims on pack, Mintel research shows consumers are looking for reduced sugar levels in a number of categories. Indeed, as many as two thirds (66%) of Polish, 60% of Spanish and 60% of French consumers agree there aren’t enough healthy sweets available, for example sugar-free varieties. What’s more, half (50%) of UK users who drink fewer carbonated soft drinks (CSDs) do so because they contain too much sugar, and 33% of German consumers prefer CSDs which are not so sweet in taste.

Despite the lack of reduced sugar claims on pack, Mintel research shows consumers are looking for reduced sugar levels in a number of categories. Indeed, as many as two thirds (66%) of Polish, 60% of Spanish and 60% of French consumers agree there aren’t enough healthy sweets available, for example sugar-free varieties. What’s more, half (50%) of UK users who drink fewer carbonated soft drinks (CSDs) do so because they contain too much sugar, and 33% of German consumers prefer CSDs which are not so sweet in taste.

Indeed it seems that ‘goodness’ and ‘naturalness’ are important factors for consumers in their perception of different sources of sugar. Mintel research found that the top sugar or sweetener ingredient consumers viewed as healthy was honey, with over four in five Polish (87%), Italian (83%) and Spanish (80%) consumers agreeing it is good for their health, as well 77% of French and 68% of German consumers.

“The spotlight is fixed on high levels of added sugar in processed foods, and the push to reduce sugar across categories is ramping up. Whilst traditionally there have been negative connotations linked to low, no or reduced products, today brands adopting this claim with regards to sugar should adopt more positive messaging, for instance by highlighting the products goodness, to appeal to consumer demand.” Chris Brockman adds.

Finally, it seems consumer interest in cutting down on sugar has sparked a taste for more sour flavours. Two in five (43%) Polish, three in ten (30%) French and one quarter (23%) of German consumers express an interest in sweets with extreme flavours, for instance sour.

“As cloyingly sweet flavours fall out of favour, sour flavours are emerging across categories as the antithesis of sweet. With today’s consumer on high alert about their sugar consumption, interest in sour flavors is expanding across categories.” Chris Brockman concludes.