Facing Up to Brexit and Price Deflation in the Food and Beverage Sector

By Ian Hunter, Senior Equity Analyst at Investec

Across our three main businesses in Investec Ireland (Corporate Treasury, Corporate Finance and Wealth & Investment), we have been working with clients to address the many challenges and opportunities thrown up by both BREXIT and deflation in food retail. Volatile currency markets pose real challenges in terms of competitiveness for exporters. Brexit has closed IPO markets for now and has led to tighter forward-financing markets, less M&A opportunities and challenges for both buyers and sellers. Lastly, more volatile investment markets prevail for both cash rich companies and high net worth individuals.

The Irish agri-food sector is one of the most important indigenous industries in Ireland, generating €26bn annually, accounting for 7.6% of Ireland’s gross value added (2014), 10.7% of Ireland’s merchandised exports (2015) and 8.4% of total employment (Q116). Of national GVA, primary agriculture, fisheries and forestry together accounted of 2.5%, while the Food & Beverage industry was responsible for 5.0%. The agri-food sector employs 166,000 (CSO 2015 survey) in which the vast majority (66%) are in the primary production side of the business, with a further 28% in the food and 4% in the beverage sectors. The remainder are employed in wood processing. The sector is highly heterogeneous so while meat (19%), dairy (19%) and beverages (12%) in total account for half of all revenue generated, 44% of revenue is classified by the CSO as “other”. The remainder is made up of animal feeds, bakery products, fish, oil/fat and grain products and fruit and vegetables.

Prepared Consumer Foods (PCF) Category

Prepared Consumer Foods (PCF) Category

The relatively newly defined prepared consumer foods (PCF) category encompasses all companies that process primary products into baked goods, snacks, confectionary, ready meals, cooked meats, chilled foods and ambient food products is important to the Irish economy. More than 500 manufacturing units spread across the country directly employ almost 21,000 workers and generate goods worth almost €4.1bn, over half of which is exported to over 150 markets worldwide. Exports were up 7% in 2015 to €2.5bn and have increased by over 25% since 2009. The largest contributor to exports and the main growth driver in 2015 was “value added” beef (up 33% to €266m). Chocolate/ confectionery contributed just under €250m (up 17%) followed by value added pigmeat (up 3% to €220m) and bakery (up 35% to €182m).

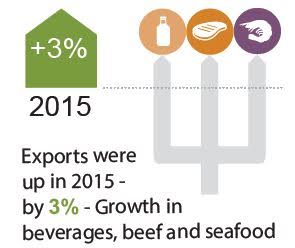

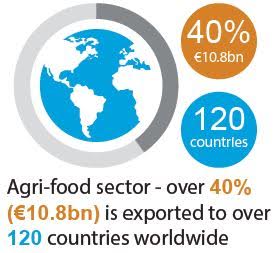

The sector is an important contributor to exports. Of the €26bn annually generated by the agri-food sector, over 40% (€10.8bn) is exported to over 120 countries worldwide. This rises to 46% (€12.0bn) when forestry, hides & skins and animal foodstuffs are included. The remainder meets the majority of Ireland’s grocery and food service requirements. Exports were up in 2015 for a sixth consecutive year, this time by 3%, driven by not only higher output but also a weakening euro against sterling. On output there was growth in beverages, beef and seafood. While increased volumes counteracted weak prices in the dairy sector, weaker prices had a negative impact on pig meat exports.

Biggest Export Partner

The UK remains our biggest export partner (41% or €4.4bn), which makes Ireland its largest supplier of food and drink. The market grew 7% in 2015, with stronger export values for beef prepared foods, mushrooms and poultry which helped offset lower beverage and dairy values. A further 31% (€3.4bn) of goods exports were to the rest of Europe, with the remaining 28% spread across the rest of the globe. There was particularly strong export growth into North America (+19%) while exports to China and the Middle East were also higher. This offset a 70% fall in exports to Russia on the current EU boycott, which is now set to last through 2016.

The UK remains our biggest export partner (41% or €4.4bn), which makes Ireland its largest supplier of food and drink. The market grew 7% in 2015, with stronger export values for beef prepared foods, mushrooms and poultry which helped offset lower beverage and dairy values. A further 31% (€3.4bn) of goods exports were to the rest of Europe, with the remaining 28% spread across the rest of the globe. There was particularly strong export growth into North America (+19%) while exports to China and the Middle East were also higher. This offset a 70% fall in exports to Russia on the current EU boycott, which is now set to last through 2016.

For the prepared consumer foods category, the UK remains the key export market, accounting for 70% in value, with trade up 11% in 2015 to €1.75bn. Exports to other EU markets were up 9% to €520m in 2015 and accounted for c.20% of total exports in the category. While larger companies such as Kerry, Aryzta, Glanbia, Dawn Farm, Green Isle, Largo Foods, Kepak and Valeo Foods account for 50% of the sector’s output, in general, PCF companies tend to be small. Over three quarters of PCF businesses employ less than 50 people. In markets where innovation, quality, brand and customer focus are key, the Irish PCF sector is seen as an enabler for the primary producers to add value and generate sales in export markets.

Expansion is not without its challenges and the current key issue is Brexit as the industry looks to address the short term (currency) and longer term (tariff concerns) impact of the EU referendum vote and positioning to continue volume, if not initially value, growth in exports into our main trading partner. A pre-Brexit scoping exercise conducted by ESRI for the Department of an Taoiseach estimated that the potential reduction in bilateral trade flows could be as high as 20% with a higher impact on agriculture, food and beverages as these sectors are more dependent on exports to the UK than other sectors. This estimate was based on a “worst case” scenario and came with the caveat that it is going to take more than two years for the UK to exit, giving time for the negotiation of post-exit positions, both nationally and at company-specific levels, the potential for EU/UK level tariffs notwithstanding. In a pre-Brexit exercise, Teagasc estimated the impact to Irish agri-food export values could be between 1.4% and 7% but cautioned that a higher degree of risk would be associated with companies with a substantial dependence on the UK market. This period of uncertainty, however, is also bound to impact the investment decisions made by those in the Irish food & beverage sector on business expansion both in Ireland and the UK.

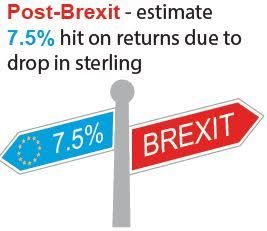

While a period of uncertainty post-Brexit is bound to impact investment decisions made by those in the Irish food & beverage sector on business expansion both in Ireland and the UK, the immediate impact has been felt in the drop in sterling. Almost overnight, Irish exports into the UK have either become 13% more expensive and, therefore, less competitive against UK produce or 13% less profitable, if retail prices are maintained. The latter appears the more obvious scenario given the current deflationary environment in the UK food sector with retailers resistant to passing on higher currency costs. Indeed, Morrisons has already indicated that there will be no post-Brexit price increases.

While exports into the UK have always been subject to the vagaries of exchange rates, the current concern is that the recent rate move proves to be a permanent structural change rather than the more usual temporary cyclical move. Many Irish Corporates have been slow to recognise this new reality and our Corporate Treasury division is seeing less commitment from Irish exporters to place FX hedges for longer periods. While the hope is that the sterling rate will improve, the concern is that it will continue to weaken, leaving exporters further exposed.

Some relief for Irish corporates may come from the fact that the Post-Brexit currency moves have also impacted food manufacturers in the UK with the drop in sterling fuelling input cost inflation. Latest data from the UK Office for National Statistics shows a 4.1% rise in all food and drink production costs between June and July 2016 compared to a 1% rise between May and June 2016. This potential relief comes with the caveat that a weaker sterling obviously means that UK produced goods are now cheaper to export and may now compete more effectively in the Irish and other export markets.

Some relief for Irish corporates may come from the fact that the Post-Brexit currency moves have also impacted food manufacturers in the UK with the drop in sterling fuelling input cost inflation. Latest data from the UK Office for National Statistics shows a 4.1% rise in all food and drink production costs between June and July 2016 compared to a 1% rise between May and June 2016. This potential relief comes with the caveat that a weaker sterling obviously means that UK produced goods are now cheaper to export and may now compete more effectively in the Irish and other export markets.

Deflationary Environment

The deflationary environment in the retail sector has provided a challenge to food and drink manufacturers for over two years. Through the 2008/09 financial crisis consumers reduced their spending on food/drink, actively shopping for lower prices without compromise on quality. While overall economic conditions have subsequently improved, consumers have remained frugal, having learnt that goods at lower prices do not necessarily mean reduced quality. This move to low cost quality products and a general reduction in waste has hit supermarket margins. They have been further exacerbated by the growth of discounters. This has led to intense price wars between supermarket chains for market share, which is squeezing agri-food and drink sector margins.

For the food and beverage sector, this pressure has been somewhat mitigated by the sustained low prices of raw material inputs, from direct inputs such as wheat, soya, edible oils, sugar and milk to indirect inputs such as crude oil (lower manufacturing, transport, etc. costs). While global wheat and maize prices are at four-year lows, Soya has picked up off a four-year low over the past six months and sugar prices have been rallying strongly over the past year. The challenge going forward will be if and when input costs, including labour, start to sustainably tick up in an environment where retail prices are static to falling, how efficiently will producers and food manufacturer s be able to pass through the increased costs.

For the food and beverage sector, this pressure has been somewhat mitigated by the sustained low prices of raw material inputs, from direct inputs such as wheat, soya, edible oils, sugar and milk to indirect inputs such as crude oil (lower manufacturing, transport, etc. costs). While global wheat and maize prices are at four-year lows, Soya has picked up off a four-year low over the past six months and sugar prices have been rallying strongly over the past year. The challenge going forward will be if and when input costs, including labour, start to sustainably tick up in an environment where retail prices are static to falling, how efficiently will producers and food manufacturer s be able to pass through the increased costs.

Brexit and the deflationary environment in the food and beverage sector present both challenges and opportunities for Irish companies in the sector both of which are being addressed by Investec. Investec Ireland actively works across the food and beverage sector both in Ireland and internationally providing hedging solutions for foreign exchange, commodity, interest rates and cash management, debt and equity capital raising, buy and sell-side M&A advice and personal financial management for key executives and shareholders. Recent transactions in the sector include the IPO of Fevertree, the investment by Spar SA in BWG Foods and the formation of Valeo Foods with the acquisition of Origin Foods, Batchelors and Jacobs Fruitfield.