Irish Grocery Market Returns to Deflation

The Irish grocery market has slipped into deflation for the first time in almost two years, dropping 0.7 percentage points month-on-month to -0.2%. This is according to the latest figures from Kantar Worldpanel in Ireland, for the 12 weeks ending 26 March 2017.

David Berry, director at Kantar Worldpanel, explains: “Only now are we starting to feel the effect of the weakened pound following the EU referendum as the price of British imports drops. For the first time since May 2015 grocery prices are falling so consumers are likely to have a little extra cash to hand, though this doesn’t necessary mean they’ll spend more in store. Many will see the break from inflation as a chance to cut down their grocery costs and pocket the savings instead.”

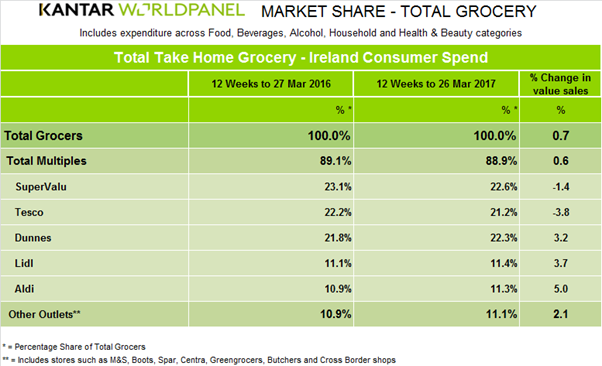

Meanwhile, SuperValu has regained the title of Ireland’s largest grocer having been pipped to the post by Dunnes Stores for the past two months.

David Berry continues: “The battle to attract shoppers remains fierce as ever as SuperValu makes its way back to the number one spot. After two consecutive months at the top, Dunnes was unable to remain Ireland’s largest supermarket for a third month with SuperValu finishing 0.3 percentage points ahead of the retailer.”

The latest figures reflect the impact of Easter on consumers and retailers alike. With the Easter weekend not until the middle of April this year, the holiday falls outside the latest 12 weeks while it was within the comparable period last year. As a result overall growth in the market fell to 0.7% – significantly below the level during the same period in 2016, demonstrating Easter’s significant boost to the market. The recent return to deflation has also contributed to the slowing of growth.

One of the main trends within the Irish grocery market this year is shoppers’ move towards own-label, with these goods now accounting for 54% of total grocery spend – up 6% in the past four years. Discount retailers Aldi and Lidl are a major contributing factor; their stock is predominantly own-label so they have driven this growth, with shoppers now also more accustomed to seeing own-label ranges on shelves.

David Berry continues: “SuperValu and Tesco have both responded and expanded their own-label ranges. The retailers see this as a real opportunity for growth, with own-label lines offering them the chance to set themselves apart from the rest. However brands are still dominating in Dunnes Stores, with own-label accounting for just 38% of sales this year – up only 1% since 2013, much lower than its competitors.”

Despite losing market share, Dunnes still has reason to celebrate. Sales grew by 3.2% year-on-year – the 30th consecutive period of growth for the retailer. Lidl’s success continues too as the retailer experiences a 3.7% increase in sales. Shoppers visited the store once more over the past 12 weeks, compared to the same period last year. Aldi remains Ireland’s fasting growing retailer with sales growing by 5.0%. The retailer increased its market share to 11.3%, closing the gap with its closest rival Lidl to just 0.1%.