Milk Alternatives to Flourish Globally

Canadean’s latest long-term forecast to 2021 highlights the dwindling consumption of white milk in the West, and the potential for milk alternatives all over the world. The market for white milk, which is defined as packaged, unflavoured milk from all animals, is set to decline in much of the developed world between 2016 and 2021, according to Canadean.

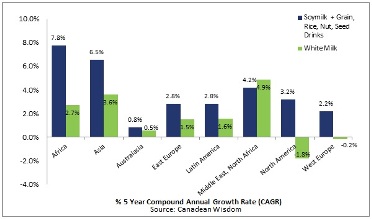

The decline will hit North America the hardest, a loss of two billion litres of white milk by 2021, a negative Compound Annual Growth Rate (CAGR) of almost 2%. This is due to reduced occasions for drinking white milk and a global trend for health and wellness, which is particularly prevalent in the West. Conversely, emerging markets are expecting an increase in white milk sales by 2021, led by the Middle East and North Africa region, where the market will expand at a CAGR of 4.9%.

The decline will hit North America the hardest, a loss of two billion litres of white milk by 2021, a negative Compound Annual Growth Rate (CAGR) of almost 2%. This is due to reduced occasions for drinking white milk and a global trend for health and wellness, which is particularly prevalent in the West. Conversely, emerging markets are expecting an increase in white milk sales by 2021, led by the Middle East and North Africa region, where the market will expand at a CAGR of 4.9%.

Canadean attributes the contraction of white milk sales in developed markets to the rapid shift away from domestic breakfast consumption, often seen as the traditional meal in which to consume milk.

Abigail Kendall, MA, Beverage Analyst at Canadean explains: “As consumers’ needs are increasingly moving towards on-the-go breakfast solutions, milk may be seen as less of a staple product with which to start the day. Additionally, purported health benefits associated with white milk consumption, such as providing protein and calcium, are being overshadowed by concerns that the beverage is high in fat.”

Furthermore, the strong growth of milk markets in emerging countries such as Chile can partly be attributed to school milk programs, a concept that is less popular in Western countries due to lifestyle differences.

Abigail Kendall continues: “Milk alternatives such as soymilk are increasingly viewed as fashionable drinks and a more health-conscious choice compared to white milk. This trend is complemented by the growing popularity of veganism and increasing incidences of lactose intolerance in the general population. Consumers like innovation in their drinks and this can be found in newer milk categories which appear to be more attractive than the mature white milk category. As such, soymilk and milk alternatives should expect to enjoy growth in every region in the world by 2021.”