Solid Performance From Dairygold

Dairygold, Ireland’s largest farmer owned dairy co-operative, has reported a solid financial performance for 2016, against a backdrop of very weak returns from international dairy markets, especially in the first half of the year. Dairygold recorded turnover of €756.1 million – down from €784.9 million in 2015 – delivering an EBITDA of €39.0 million, against €41.2 million in 2015. The farmer owned co-operative achieved an operating profit of €17.5 million, (2015: €19.2 million), while increasing Milk Price support to its Members to circa €25 million, up from €20 million in 2015. At year end the net asset value of the business was €307.6 million (2015: €315.5 million), while bank debt was reduced by €7.5 million to a prudent €88.7 million.

Dairygold continued its ambitious capital programme during the year, investing a further €15 million in the business, bringing the total capital investment over the past six years to €200 million. This investment established a state-of-the-art sustainable milk processing platform, across dairy sites at Mallow and Mitchelstown. The investment has increased processing capacity by 55% enabling farmer Members to fulfil their on-farm growth ambition but more importantly the business can now leverage its investments in infrastructure to progress value added commercial opportunities.

Dairygold also strengthened its track record in building strong commercial partnerships with global food companies with the announcement of the planned development of the new Jarlsberg® Cheese production facility in partnership with Norway’s largest dairy processor Tine SA. This will quadruple the current Jarlsberg® Cheese production at Dairygold’s Mogeely plant.

Jim Woulfe, chief executive of Dairygold, comments: “Our commercial partnerships with global food companies have been an avenue to significant value add for the business. We will continue to seek out strategic partnerships with leading global organisations that can leverage our best in class processing facilities to deliver more value added production for the business.”

He adds: “Dairygold has successfully transitioned from the quota controlled production era to the more volatile, expansionary environment. We are now following a very clear strategic path. We have built a first class processing platform and realigned our organisational structure. We have invested in the people and capability and put the appropriate financing in place, to deliver on our value added commercial objectives. We are now on the cusp of leveraging these investments to progress on our future strategy. Dairygold’s strategic growth ambitions are now specifically focused on developing value added nutritional opportunities, both through commercial partnerships and through acquisition.”

He adds: “Dairygold has successfully transitioned from the quota controlled production era to the more volatile, expansionary environment. We are now following a very clear strategic path. We have built a first class processing platform and realigned our organisational structure. We have invested in the people and capability and put the appropriate financing in place, to deliver on our value added commercial objectives. We are now on the cusp of leveraging these investments to progress on our future strategy. Dairygold’s strategic growth ambitions are now specifically focused on developing value added nutritional opportunities, both through commercial partnerships and through acquisition.”

According to Jim Woulfe, the year ended with a more positive outlook for Milk Price but that some uncertainties remained. “2016 was a year of two halves as far as dairy markets were concerned,” he says. “The first half saw continued volatility with declining market returns but as we moved into the second half we began to experience a change in the market dynamic, with global milk output slowing down across all regions except for the USA, where cheap feed inputs continue to be a stimulus to drive milk production. The slowdown in milk output helped to generate market demand and global dairy prices rose slowly but steadily from a very low base.”

However, while overall import figures for the major dairy importing countries did recover and 2016 ended with a positive outlook for Milk Price, concern remains in relation to the overhang of dairy stocks, and milk powders in particular.

Brexit

“With the formal triggering of Article 50 of the Lisbon Treaty by the UK, we are now on a path towards Brexit which will have a profound impact on the Irish dairy and food industry regardless of how ‘soft’ or ‘hard’ it may be,” Jim Woulfe points out. “Together with other cheese producers in the dairy industry and with Government involvement we need collectively to address Brexit challenges for Ireland’s cheese exports of which 60% of Irish product is sold into the UK. We must continue to pursue strategies to diversify markets and to continue to add value to our dairy output, to minimise the impact of Brexit.”

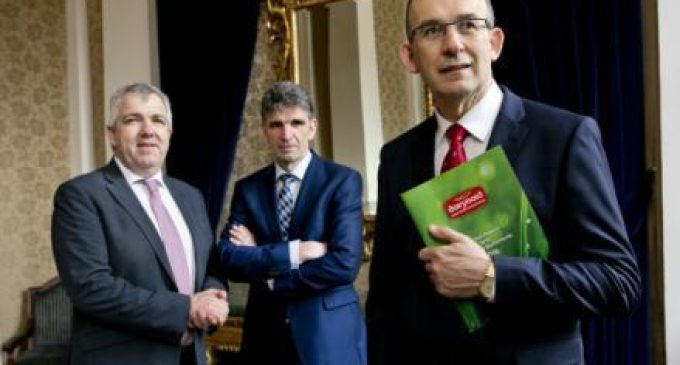

CAPTION:

Pictured above right (left to right): James Lynch, chairman; Michael Harte, chief financial officer; and Jim Woulfe, chief executive of Dairygold.