Unlikely drivers in the Swedish confectionery market

Chocolate still rules the roost in Sweden, but two improbable sub-segments are set to help the sugar confectionery category grow faster in the next five years, according to market analysts Canadean.

Caramels & toffees and medicated confectionery are forecast to propel the $280m Swedish sugar confectionery segment up 1.4% in value sales by 2017 – 0.2% faster than the chocolate sector.

Rare occasions

Speaking to ConfectioneryNews, Canadean report analyst Ronan Stafford acknowledged that the figures were not dramatically high and reflected stagnation in overall food in Sweden due to the economic climate.

But he said that caramels & toffees and medicated confectionery were segments that can either profit from or remain unaffected by economic hardship.

“What we are losing is our impulse snack or daily treat,” said Stafford, explaining why chocolate was growing at a slightly slower rate.

“If you want to grow the category you have to go for the rare occasions.

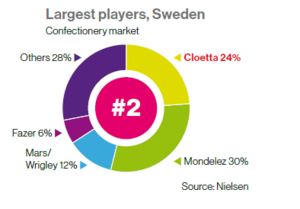

Confectionery market share in Sweden. Source Nielsen and Cloetta Annual Report

“A lot of the growth in caramels & toffees is being driven by gifting…Secondly, medicated confectionery is far more likely to withstand poor economic conditions because it’s medicinal.”

Caramels & toffees and medicated confectionery

The caramel & toffees segment is the second largest sugar confectionery category in Sweden behind gums and jellies and had value sales of $56m in 2012. Canadean forecasts the segment will have a compound annual growth rate (CAGR) of 2% up until 2017.

Medicated confectionery is the second smallest segment in the sugar confectionery just ahead of mints. It is currently pegged at $27m and is set for a 1.9% CAGR by 2017.

However, Stafford said that growth in medical lozenges is Sweden was not unique and was in line with the overall European picture.

Swedish confectionery market in figures

| Segment | 2012 Value Sales (US $) | 2012-17 CAGR | 2012 Value Share |

| Confectionery | 1.3bn | 1.3% | – |

| Chocolate | 959m | 1.2% | 72.3% |

| Gum | 88.5m | 1% | 6.7% |

| Sugar Confectionery | 280m | 1.4% | 25.6% |

Low per capita consumption

“There’s much less of a sweet tooth in Sweden,” continued Stafford.

Sales channels for confectionery are expected to remain unchanged. Hypermarkets and supermarkets account for half of all sales, while convenience stores make up 28% of confectionery sales.Per capita confectionery consumption is far lower in Sweden (3.6 kg) than many neighbouring countries, such as Finland (6.4 kg), Demark (11 kg) and Norway (12 kg).